BNPL vs Credit Cards. is BNPL a scam?

Image source: Connective payments

Let's clear that, how credit cards work.

Credit cards are directly issued by the banks and they lend you their money. Simply, you are using the bank's money directly. Banks give you a specific 30 to 45 days period to return/repay that money without zero interest or you can also pay money in EMIs.

If you didn't repay the money in that period then banks charges interest of about 24% to 48% p.a. as fees. But this bank's money when you use it shows in the bank's loan book.

For example, if you use the credit card of XYZ bank and purchase RS5000 worth of anything then it will be recorded in the bank's loan book that RS5000 is lent to this specific person.

Now you might get understood how credit cards work.

Let's see how BNPL(buy now pay later)/postpaid services work.

BNPL also lend you money with no extra cost for some time just like credit cards. But the uses of it, are very different from a credit card. You open the specific app and scan the QR code and simply payment gets done. But this was not your money, this was banks' money used by fintech company BNPLs. And if the money gets defaulted then fintech has an agreement with the banks that 15% to 20% of the losses will be beard by them ( Fintech (BNPL). But what if the people cannot repay these loans, so one day RBI will come and say all the fintech are banned and now we are increasing interest rate so it will lead to a decrease of demand and essentially the economy will get slow down.

Here is the dark side of BNPL,

It is a very huge market, it grew up by 569% in the year 2020 and in 2021 it grew up by 637%.

According to the redseer report, this market can grow up to $40 billion by 2025 at the rate of 65% yoy ( year-on-year ) growth.

This is dangerous because the consumers are misled by this kind of service. They show you the offers and discounts and urge you to buy that particular thing immediately and these things fit in your mind and divert your mind from your saving goal.

When you see ads or a discount where they offer that discount on BNPL service and they force you to avail the discount through BNPL and you get stuck in that. For that particular time, you think that you are not buying this from your money this is there's ( BNPL's ) money, but this is the trap where they set for you and you get stuck in it. You buy and you repay later again you buy it and again you repeat this.

Essentially they burn your money and force you to buy something that you don't want to buy.

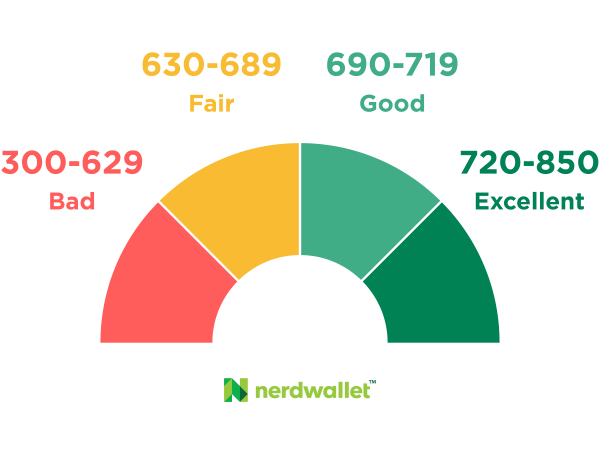

Image source: Nerd Wallet

This is dangerous because the consumers are misled by this kind of service. They show you the offers and discounts and urge you to buy that particular thing immediately and these things fit in your mind and divert your mind from your saving goal.

When you see ads or a discount where they offer that discount on BNPL service and they force you to avail the discount through BNPL and you get stuck in that. For that particular time, you think that you are not buying this from your money this is there's ( BNPL's ) money, but this is the trap where they set for you and you get stuck in it. You buy and you repay later again you buy it and again you repeat this.

Essentially they burn your money and force you to buy something that you don't want to buy.

Image source: Nerd Wallet

If you see your credit report later then you will notice that this was added to your credit report as a personal loan but even you didn't take that loan because we cannot say that personal loan. They never tell us that this is a personal loan.

Here is how the consumer gets stuck with the services.

Now, should you be applying or not?

See if you are a responsible person and you know that, where you should spend your money then you should go for it. Because banks don't give you a credit card directly, they will always see your credit score.

This BNPL service may help you to build your credit score and later that you can discontinue this service and apply for the proper credit card.

Usage for up to 6 months, you can build your credit score by buying sensibly and responsibly.

MITHILESH

Comments

Post a Comment